The Top 5 Mistakes Veterans Make When Buying a Home in Tampa

The Top 5 Mistakes Veterans Make When Buying a Home in Tampa

Avoid these common pitfalls and make the most of your VA loan benefits in Tampa Bay.

Buying a home in Tampa can be exciting, especially for Veterans and military families taking advantage of their VA benefits. But I’ve seen too many Veterans run into avoidable problems that cost them time, money, and peace of mind.

If you’re planning to use your VA loan or relocate to the Tampa Bay area, here are the top 5 mistakes Veterans make when buying a home in Tampa — and how you can avoid them.

🎖️ Veterans, this guide is for you. Whether you’re relocating to Tampa or buying your first home with a VA loan, these tips can save you time and money.

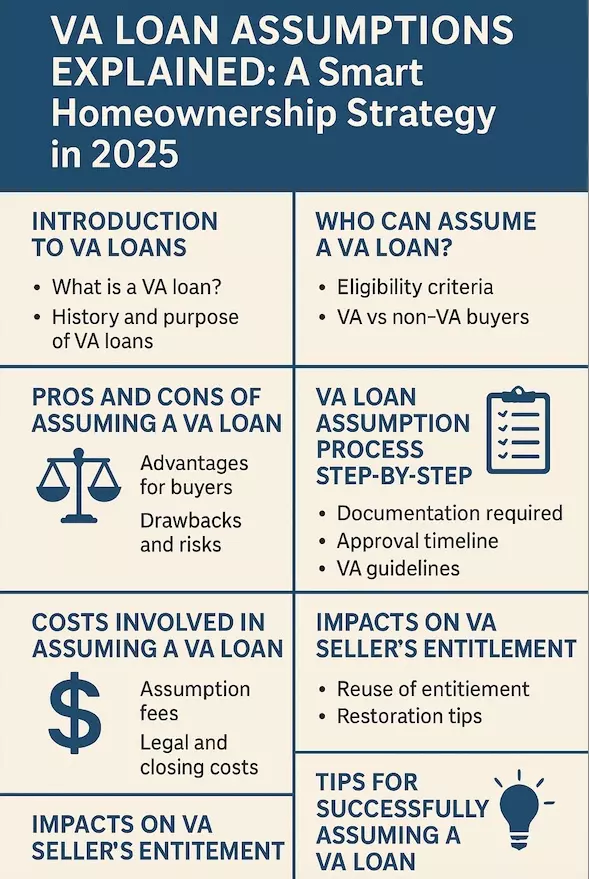

Mistake #1: Not Using VA Loan Benefits Fully

Many Veterans underestimate the power of their VA loan. Zero down payment, no private mortgage insurance, and competitive interest rates make it one of the best financing tools available.

Yet I meet Veterans all the time who are told they can’t compete with cash buyers or conventional loans. That’s just not true. With the right preparation and an experienced agent, VA buyers win in Tampa every day.

Tip: Make sure you’re working with a VA-experienced lender and agent who understand how to make your offer stand out.

💡 VA loans aren’t weaker offers — with the right strategy, they win in Tampa every day.

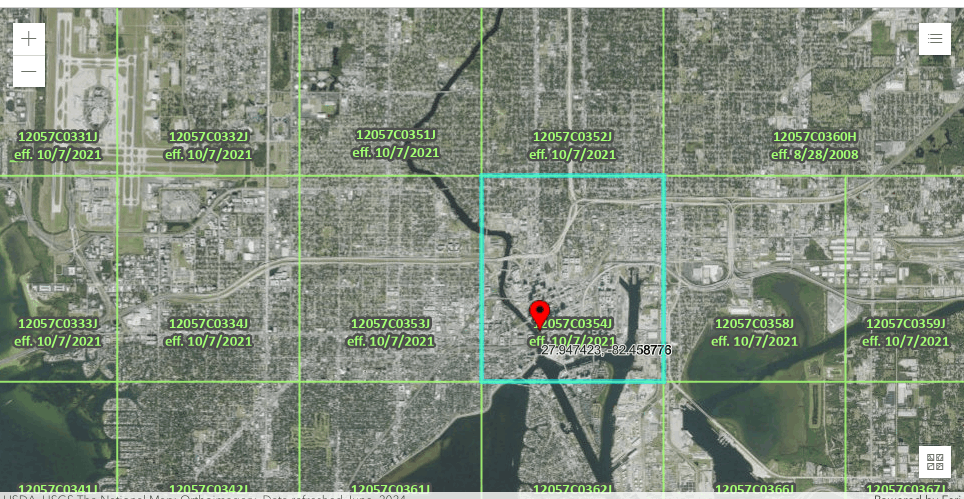

Mistake #2: Overlooking Tampa Flood Zones

Tampa is paradise, but we’re also on the water — which means flood zones matter. Buying in a high-risk area without considering insurance costs can add hundreds to your monthly payment.

For example, some homes in South Tampa or near the bay require flood insurance that runs $200–$400 per month.

Tip: Before falling in love with a home, check the flood zone and get a quick insurance estimate. Sometimes just moving a few streets over can save you thousands.

🚨 Some flood zones can add $200–$400 per month in insurance costs.

Mistake #3: Competing Blind in a Hot Market

The Tampa real estate market is competitive. Many Veterans think they’ll lose out because sellers don’t “like” VA loans. The truth? Most sellers just want a smooth, reliable closing.

With a strong pre-approval, clear offer terms, and a knowledgeable agent, your VA loan offer can be just as attractive as cash.

Tip: Get pre-approved early and make sure your lender can close VA loans quickly — it makes a huge difference.

Mistake #3: Competing Blind in a Hot Market

The Tampa real estate market is competitive. Many Veterans think they’ll lose out because sellers don’t “like” VA loans. The truth? Most sellers just want a smooth, reliable closing.

With a strong pre-approval, clear offer terms, and a knowledgeable agent, your VA loan offer can be just as attractive as cash.

Tip: Get pre-approved early and make sure your lender can close VA loans quickly — it makes a huge difference.

Quick Bullet List:

- Strong pre-approval ✅

- VA-savvy lender ✅

- Clear offer terms ✅

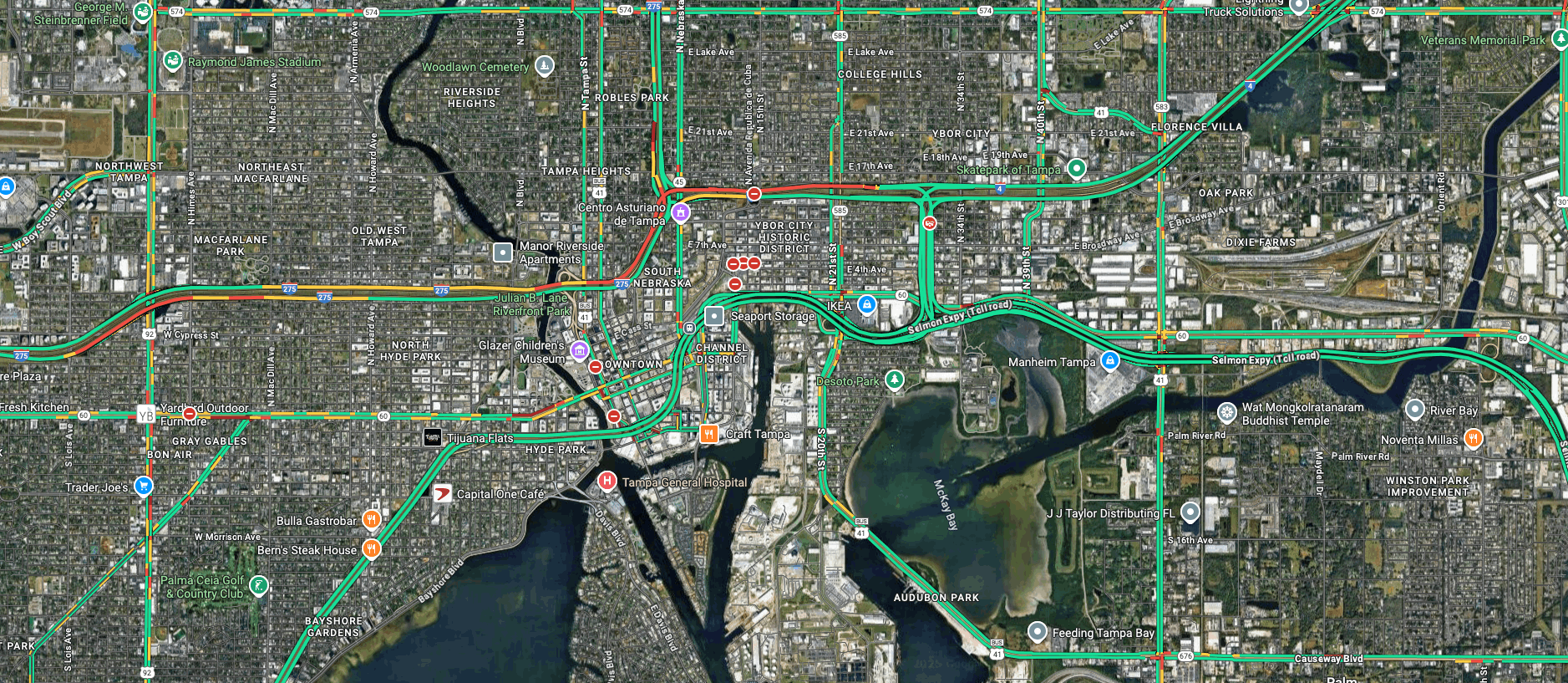

Mistake #4: Ignoring Commute and Lifestyle Fit

Tampa has a lot of great neighborhoods, but not everyone is the right fit for military families or Veterans.

For example:

- South Tampaoffers quick access to MacDill AFB, but home prices and flood zones can be higher.

- Riverview and Brandonare popular for families with good schools and easier commutes.

- Wesley Chapelis growing fast, with new homes and amenities, but it comes with a longer drive.

Tip: Think beyond the house itself. Consider your daily commute, school districts, and nearby amenities.

Mistake #5: Skipping the Right Inspections

Tampa homes face unique challenges: heavy rain, humidity, and storm risks. Skipping important inspections can lead to costly surprises. Our team has trusted vendors to navigate these critical, required inspections.

A roof near the end of its life or an outdated HVAC system can also make insurance tricky.

Tip: 4-point inspection (roof, HVAC, electrical, plumbing) is required on homes that are older than a couple of years to get insurance.

- Checklist Callout:

✅ Roof condition

✅ HVAC system age

✅ Electrical & plumbing updates

✅ 4-point inspection required for insurance

🎖️ Sunny Alexander + Mike Beum with Red Sash Realty, and we specialize in helping Veterans and military families buy with confidence in Tampa Bay.

👉 Thinking about buying in Tampa? Reach out today and let’s find the right home for you.

Categories

Recent Posts

GET MORE INFORMATION

Broker-Owner