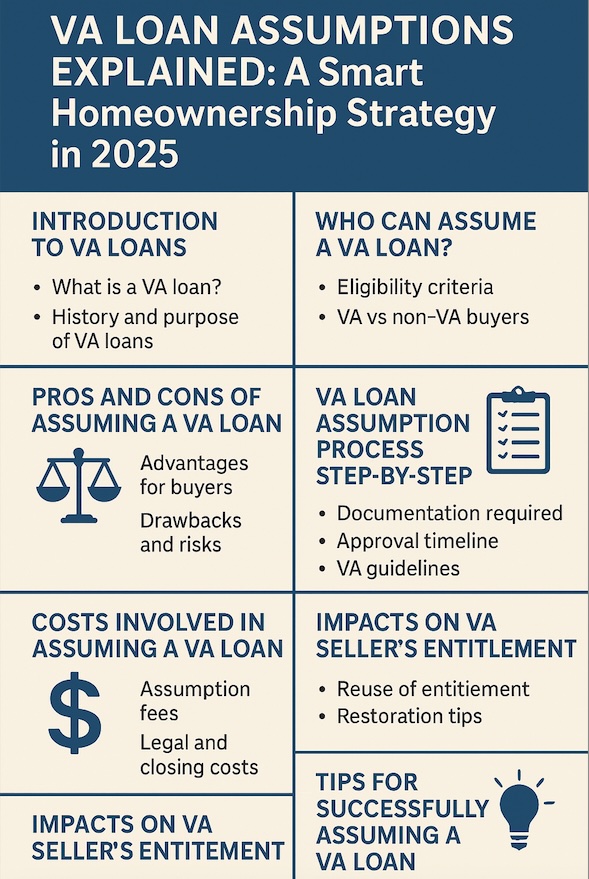

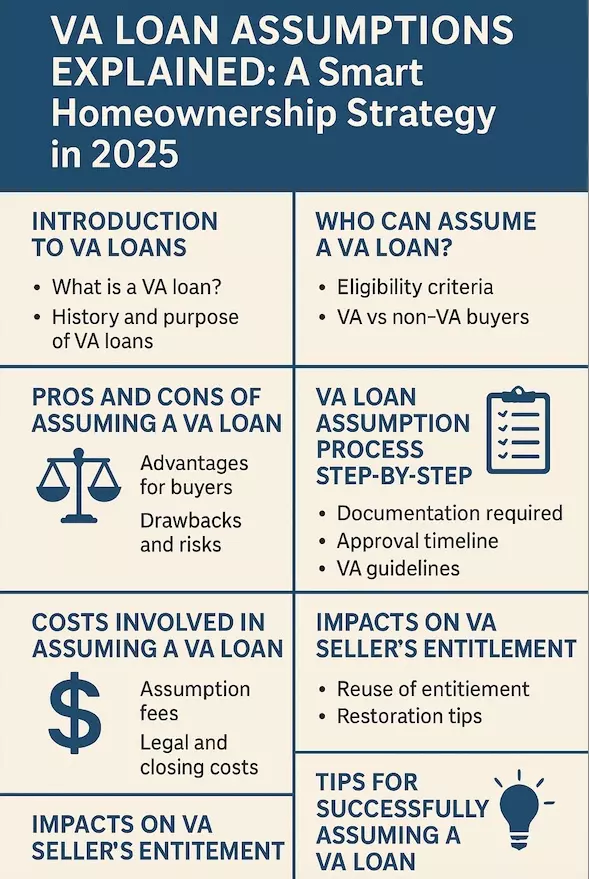

Costs Involved in Assuming a VA Loan

While assuming a VA loan can save money in the long run, it’s essential to understand the associated costs upfront.

Typical Fees:

- VA Assumption Fee:Generally 0.5% of the loan amount. For example, on a $250,000 loan, the fee would be $1,250.

- Legal Fees:Document preparation, title transfer, and attorney review may apply depending on your state.

- Appraisal or Inspection (Optional):Not always required, but some lenders may request one to assess property condition.

Despite these, assumption costs are usually lower than conventional mortgage closing fees, making it an appealing financial choice.

Impacts on VA Seller’s Entitlement

If the person assuming your loan is not VA-eligible, your entitlement will remain tied to the property until the loan is paid off. This could prevent you from using your full VA benefits to purchase another home.

However, if a qualified veteran assumes the loan, the seller’s entitlement can be restored immediately.

Tips to Protect Entitlement:

- Ensure the buyer is VA-eligible.

- Get a formal release of liability from your lender.

- Request a Substitution of Entitlement through the VA.

Role of Lenders in VA Loan Assumptions

Lenders play a crucial role in the approval and execution of a VA loan assumption. Though the VA guarantees the loan, the lender holds the decision-making power in approving the new borrower.

Lender Requirements:

- Creditworthiness check

- Debt-to-income ratio evaluation

- Employment verification

They may deny the assumption if the buyer fails to meet these financial standards—even if they are VA-eligible.

Can Civilians Assume a VA Loan?

Yes, civilians or non-military buyers can assume a VA loan, but with a caveat: the original veteran seller’s entitlement will not be restored unless the new buyer is VA-eligible.

Why This Matters:

- The veteran may be unable to reuse their VA loan benefits.

- It could restrict future home purchases or refinancing options.

For this reason, many sellers prefer another VA borrower as the assumer.

Assumable Mortgage Market in 2025

Due to increased interest rates and inflation, the demand for assumable mortgages—particularly VA loans—has grown significantly in 2025. Buyers are looking for creative ways to cut costs and lock in lower rates, making VA assumptions highly attractive.

Trends:

- Realtors are marketing properties as “VA assumable.”

- Increased lender awareness of VA assumptions.

- Popularity among first-time homebuyers and military families.

Common Misconceptions About VA Loan Assumptions

Myth 1: Only veterans can assume VA loans.

Truth: Anyone can, provided they qualify and get lender approval.

Myth 2: The process is simple and fast.

Truth: It can take 1-2 months and requires full documentation.

Myth 3: No down payment is needed.

Truth: Some assumptions may require a significant down payment, especially if there’s equity in the home.

Tips for Successfully Assuming a VA Loan

- Get Pre-Qualified:Know your financial standing before approaching the lender.

- Hire a VA-Savvy Realtor:They can help streamline the process.

- Work With a VA-Experienced Lender:Ensure they understand the nuances of VA loans.

- Verify Entitlement Status:Sellers should check how their benefits will be affected.

Real-Life Examples of VA Loan Assumptions

Case Study 1:

- Buyer:Civilian with excellent credit

- Seller:Army veteran with 2.75% fixed VA loan

- Result:Buyer assumed the loan with a $40,000 down payment and saved $75,000 over 30 years

Case Study 2:

- Buyer:Navy veteran

- Seller:Marine Corps vet

- Result:Entitlement was restored to the seller, and buyer got approved in 21 days

These stories illustrate how VA loan assumptions can benefit both parties when handled correctly.

Legal Considerations in VA Loan Assumptions

The legalities around assuming a mortgage shouldn’t be overlooked. The VA and lender require formal paperwork to:

- Transfer loan responsibility

- Update title ownership

- Protect the seller from future financial liability

Failure to legally assume a VA loan can lead to foreclosure issues or credit complications for both parties.

FAQs About VA Loan Assumptions

- Do VA loans have to be assumed by another veteran?

No. Anyone can assume a VA loan with lender approval. However, only veterans can substitute entitlement.

- What credit score is needed to assume a VA loan?

Most lenders require a credit score of at least 620, but it varies.

- Are VA loan assumptions faster than refinancing?

Yes, in many cases. The assumption process can be faster and involves fewer fees.

- Can I assume a VA loan if I’m not a first-time homebuyer?

Yes, prior homeownership does not disqualify you.

- Can a VA loan be assumed with bad credit?

Unlikely. Lenders require a solid financial profile to approve assumptions.

- Does the VA need to approve every loan assumption?

Not directly. The VA sets the guidelines, but lenders make the final call.

Conclusion

In a world of fluctuating interest rates and tightening credit, VA loan assumptions offer a powerful and underutilized path to homeownership. Whether you’re a buyer looking to snag a low-rate mortgage or a seller hoping to transfer your loan smoothly, understanding the VA loan assumption process can lead to significant financial advantages.

By knowing the rules, working with experienced professionals, and planning ahead, you can make the most of this strategic home financing tool in 2025 and beyond.

Categories

Recent Posts

GET MORE INFORMATION

Broker-Owner